does massachusetts have an estate or inheritance tax

Its part of the larger Mesoamerican Barrier Reef. Maryland is the only state to impose both a state estate tax rate and a state inheritance tax rate.

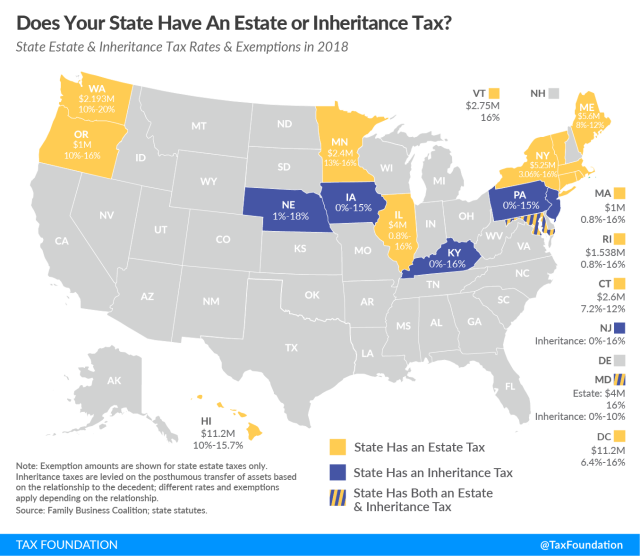

Tax Foundation Most States Moving Away From Estate Inheritance Taxes Wa Has Nation S Highest Estate Tax Rate Opportunity Washington

3 hours agoIn the wake of Queen Elizabeth IIs death last Thursday King Charles III inherited a realm of wealth and he doesnt have to pay inheritance tax on any of it.

. What is the most you can inherit without paying taxes. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. In 2020 there is an estate tax exemption of 1158 million meaning you.

Fortunately Massachusetts does not levy an inheritance tax. Massachusetts and Oregon have. One of the greatest marvels of the marine world the Belize Barrier Reef runs 190 miles along the Central American countrys Caribbean coast.

A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both. Massachusetts does not have an inheritance tax. The estate tax is a tax paid by the estate of a deceased person if the taxable.

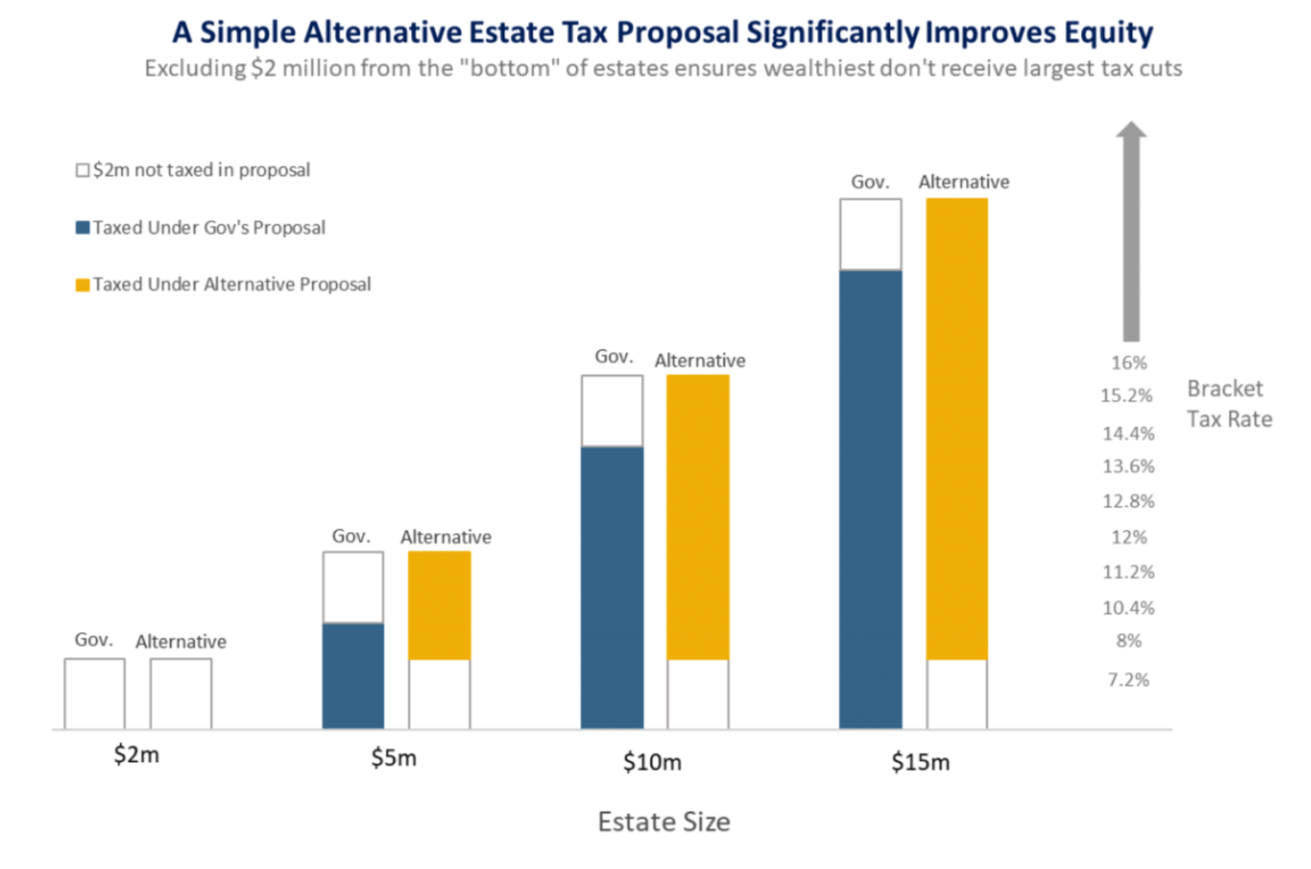

Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the. A family trust can have significant savings for Massachusetts couples in this example 200000. Well in short that means that if you die during 2006 or any time thereafter you do not need to file a Massachusetts estate tax return if you have less than 1000000 in assets.

2 days agoTo that end King Charles wont face the UKs 40 inheritance tax which otherwise would have eaten up about 200 million of his mothers estate. Connecticuts estate tax will have a flat rate of 12 percent by 2023. A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both.

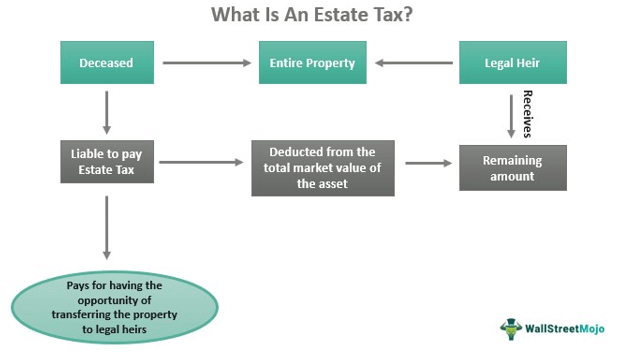

Ad Inheritance and Estate Planning Guidance With Simple Pricing. The graduated tax rates are capped at 16. The terms inheritance tax and estate tax are often used interchangeably but they are very different things.

Estate taxes are paid by the decedents estate before assets are. If the estate is worth less than 1000000 you dont need to file a return or. Any family estate in Massachusetts worth 1 million can benefit from.

Massachusetts Estate Tax Everything You Need To Know Smartasset

What Is An Estate Tax Napkin Finance

Create An Expat Will Canadians Living In The Usa Or Abroad Last Will And Testament Estate Planning Will And Testament

A New Tax Study Should Freak Out Billionaires

Current Estate Tax Proposals Would Give Largest Benefits To Wealthiest Estates Alternative Method Would Fix This Problem Mass Budget And Policy Center

A Guide To Estate Taxes Mass Gov

Estate Tax Meaning Exemption 2021 22 Vs Inheritance Tax

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Federal Gift Tax Vs California Inheritance Tax

Inheritance Tax Here S Who Pays And In Which States Bankrate

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Will You Need To Pay Taxes On An Inherited Home Surprenant Beneski

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Sell My House Property Fast For Cash In Massachusetts In 2022 Sell Your House Fast Sell My House Fast Selling Your House